child tax credit october 2021 schedule

Up to 300 dollars or 250. The payments will be paid via direct deposit or check.

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty.

. Couples making less than 150000 and single parents also called Head. 16 October 2021 0558 EDT. By Aimee Picchi.

What is the schedule for 2021. The schedule of payments moving forward will be as follows. Ad Tax Strategies that move you closer to your financial goals and objectives.

Each payment will be up to 300 for each qualifying child. See what makes us different. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The complete 2021 child tax credit payments schedule. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow.

October 14 2021 459 PM CBS Chicago. Six payments of the Child Tax Credit were and are due this year. The new advance Child Tax Credit is based on your previously filed tax return.

Up to 300 dollars or 250 dollars depending on age of child August 15 PAID. Home of the Free Federal Tax Return. Have been a US.

We provide guidance at critical junctures in your personal and professional life. October 5 2022 Havent received your payment. October 14 2021 726 AM MoneyWatch.

The Child Tax Credit is a tax benefit to help families who are raising children. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. What is the schedule for 2021.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. 15 opt out by Oct. Recipients can claim up to 1800 per child under six this year split into the six.

We dont make judgments or prescribe specific policies. E-File Directly to the IRS. Ad File State And Federal For Free With TurboTax Free Edition.

October 14 2021 559 PM CBS Detroit. Child tax credit october 2021 schedule Thursday February 17 2022 Edit. Nearly all families with kids will qualify.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The Next Deadline For Opting Out Of The Monthly Child Credit Payments Will Be Here Soon Use The Irs S. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Ontario trillium benefit OTB Includes Ontario energy and property. If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return. Wait 10 working days from the payment date to contact us.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Definition Taxedu Tax Foundation

The Child Tax Credit Toolkit The White House

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Childctc The Child Tax Credit The White House

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Child Tax Credit Payments Will Start In July The New York Times

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

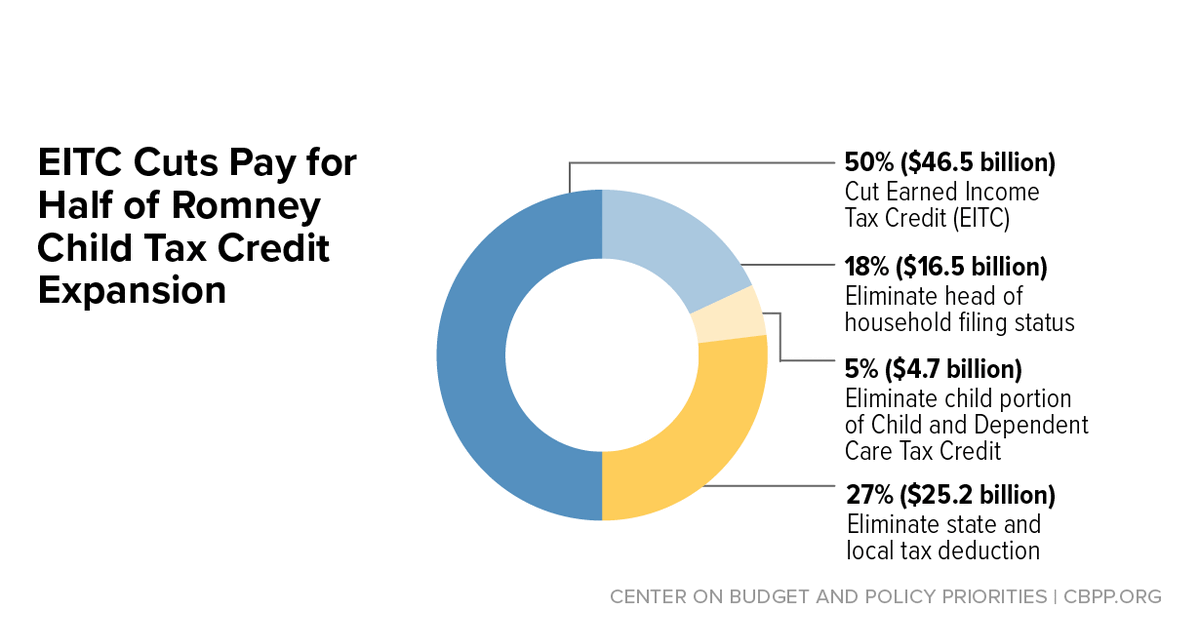

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities